NPS Return Calculator

Calculate your Net Promoter Score and understand customer loyalty

Input Response Data

Results

What does your NPS mean?

Enter your data and calculate to see the interpretation of your NPS score.

Retirement planning is a big deal in personal finance these days, especially in India. With people living longer and inflation creeping up, having a solid financial cushion after you stop working is more important than ever. Among all the options out there, the National Pension System (NPS) shines as a reliable, government-supported way to build long-term savings and security.To make things clearer for NPS users, the NPS Return Calculator has become a go-to online tool. It lets you estimate how your contributions might grow over time, so you can make smarter choices about your pension savings. In this article, we’ll dive into why this calculator matters, how it works, and why every NPS subscriber should give it a try.

Understanding the National Pension System (NPS)

The National Pension System is a voluntary retirement plan where you contribute regularly, and it’s overseen by the Pension Fund Regulatory and Development Authority (PFRDA). It’s available to all Indian citizens aged 18 to 70, whether you’re in the private sector or working for the government.

With NPS, your contributions go into a retirement account invested in things like stocks, corporate bonds, government securities, and even alternative funds. Over the years, your savings grow based on how the market performs and the investment choices you make. When you retire, you can take out a chunk as a lump sum, and the rest buys an annuity that gives you a steady monthly income.

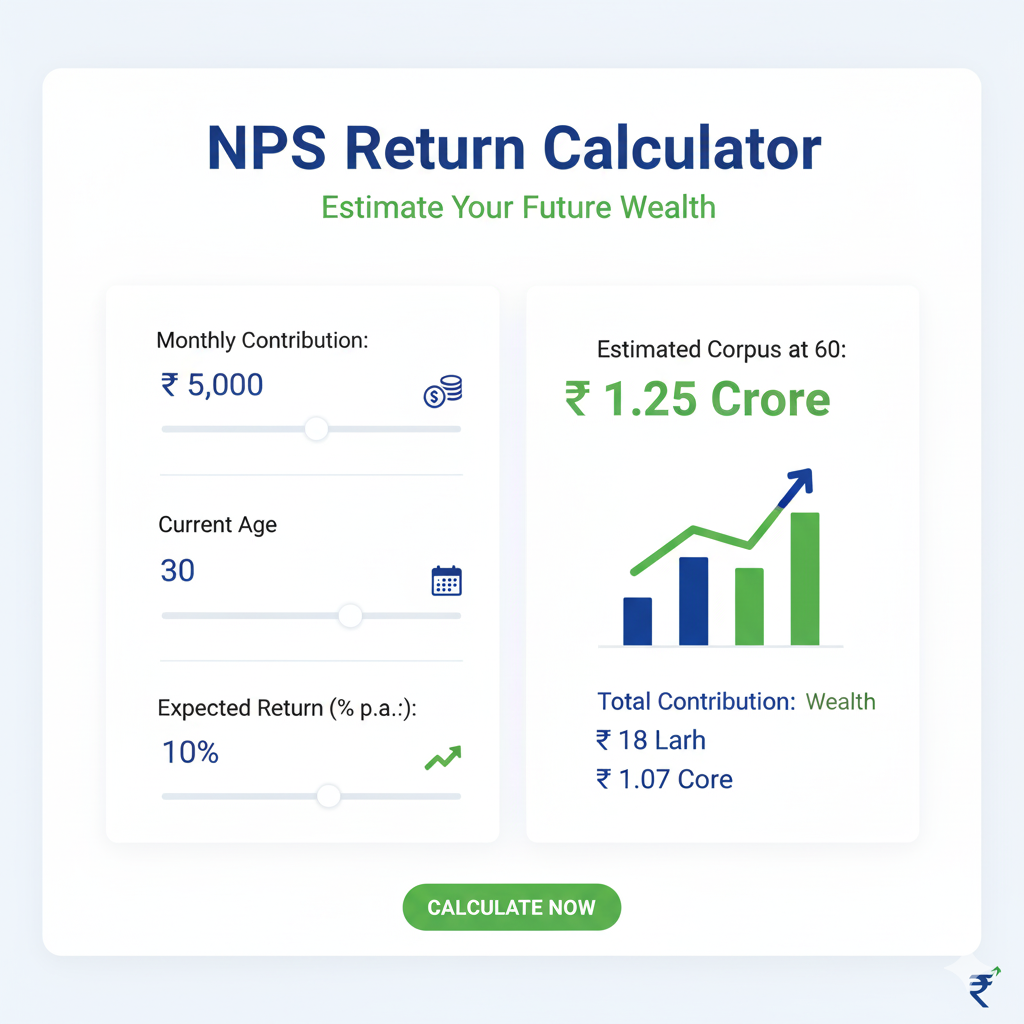

What is the NPS Return Calculator

The NPS Return Calculator is a handy online tool that helps you forecast your retirement savings and see how your NPS contributions could grow. You plug in details like your age, how much you’re putting in, the expected returns, and when you plan to retire, and it shows you a projection of your future corpus.

This isn’t just about numbers—it lets you tweak your contributions or investment approach to hit your retirement targets.

How the NPS Return Calculator Works

The calculator uses compounding math and market-based estimates to do its magic:

- Input Variables: You enter your current age, retirement age, contribution amount (monthly or yearly), and an expected rate of return.

- Corpus Calculation: It crunches the numbers with compounding to figure out your total savings at retirement.

- Asset Allocation Impact: Based on your mix of investments (like more stocks for growth or bonds for safety), it adjusts the expected returns.

- Annuity Estimation: It can also show how much of your corpus goes toward an annuity and what that might mean for your monthly pension.

This gives you a practical view of how your NPS could shape up, making planning a lot easier.

Example of NPS Return Calculation

Let’s say you’re 30 years old and starting with NPS:

- Monthly Contribution: ₹5,000

- Retirement Age: 60

- Expected Annual Return: 9%

- Annuity Rate: 6%

Plugging this into the calculator, you might get something like:

- Total Corpus at 60: Around ₹98 lakh

- Lump Sum Withdrawal (60%): ₹58.8 lakh

- Annuity Portion (40%): ₹39.2 lakh

- Monthly Pension from Annuity: ₹19,500–₹20,000

This shows just how powerful regular saving and compounding can be in creating a nice nest egg.

Benefits of Using an NPS Return Calculator

Using this tool comes with some real perks:

- Clear Projections: It helps you see how your money grows over the years.

- Goal Setting: You can set realistic targets for your retirement.

- Contribution Adjustment: Play around with how much you save to reach your goals.

- Scenario Testing: Try out different return rates or time frames.

- Time Efficiency: No need for tricky math on your own.

These features make it simpler to build a strong retirement strategy.

Factors Affecting NPS Returns

Your projected returns depend on a few key things:

- Contribution Amount: More money in means a bigger corpus out.

- Investment Tenure: The longer you invest, the more compounding helps.

- Asset Allocation: Going heavy on equities might boost returns but adds risk; debt keeps things steadier.

- Rate of Return: What you assume here makes a big difference in the final amount.

- Annuity Rate: This affects your pension payout when you retire.

- Inflation: Calculators often show nominal figures, but inflation eats into what your money can actually buy later.

How to Use the NPS Return Calculator Effectively

Getting started is straightforward:

- Enter your current age and when you want to retire.

- Add your monthly or yearly contribution.

- Pick an expected return rate based on your investments.

- Choose how much of your corpus goes to an annuity.

- Check out the projected corpus, lump sum, and pension.

- Tweak the numbers to see different outcomes.

Experimenting like this helps you customize your plan to fit your life.

Types of NPS Return Calculators

There are a few variations out there for different needs:

- NPS Calculator for Private Sector Employees: Focuses on corpus and pension for non-government workers.

- NPS Calculator for Government Employees: Factors in employer matches for better accuracy.

- SBI NPS Return Calculator: User-friendly for SBI customers with seamless integration.

- General NPS Growth Calculator: Lets you test various asset mixes and returns.

Tax Benefits of NPS

Beyond growth, NPS gives you some nice tax breaks:

- Deductions up to ₹1.5 lakh under Section 80C for your contributions.

- Extra ₹50,000 deduction under Section 80CCD(1B).

- Employer contributions qualify under Section 80CCD(2).

Pairing the calculator with tax tools can help you save even more while growing your savings.

Advantages of Using the NPS Return Calculator

- Simplifies Planning: Turns complex retirement stuff into something easy to grasp.

- Increases Financial Awareness: Highlights the effects of compounding and consistent saving.

- Supports Decision-Making: Guides you on contributions, retirement timing, and investments.

- Encourages Consistency: Seeing the projections motivates you to keep at it.

- Provides Transparency: Offers straightforward views of your future corpus and income.

Limitations of NPS Return Calculators

It’s a great tool, but keep in mind:

- Market returns aren’t guaranteed and can go up or down.

- Inflation isn’t always built in, which can skew real-world value.

- Annuity rates might change by the time you retire, affecting your pension.

- These are just estimates, not promises.

Use it as a helpful guide, but don’t base everything on it alone.

Maximizing Retirement Benefits with NPS

To get the best out of NPS:

- Start early to let compounding do its thing.

- Bump up contributions as your income grows.

- Balance equities and debt for optimal growth with manageable risk.

- Check in with the calculator regularly.

- Adapt your plan as life or markets change.

Future of NPS Return Calculators

As tech gets smarter, these calculators will too. Look out for:

- AI-driven personal forecasts.

- Projections that factor in inflation.

- Mobile apps for on-the-go tracking.

- Suggestions tailored to your risk level and timeline.

This will make planning even more accurate and convenient.

Frequently Asked Questions on NPS Return Calculator

Conclusion

The NPS Return Calculator is a must-have for anyone in the National Pension System. It makes planning straightforward, shows how your savings can grow, and helps you decide on contributions and investments wisely.

By using it often, reviewing your projections, and making adjustments, you can aim for a secure retirement. With NPS’s government support, market potential, and tax perks, this tool puts you in control of your financial future.

If you’re serious about retiring comfortably, the NPS Return Calculator isn’t optional—it’s key to building independence and peace of mind.