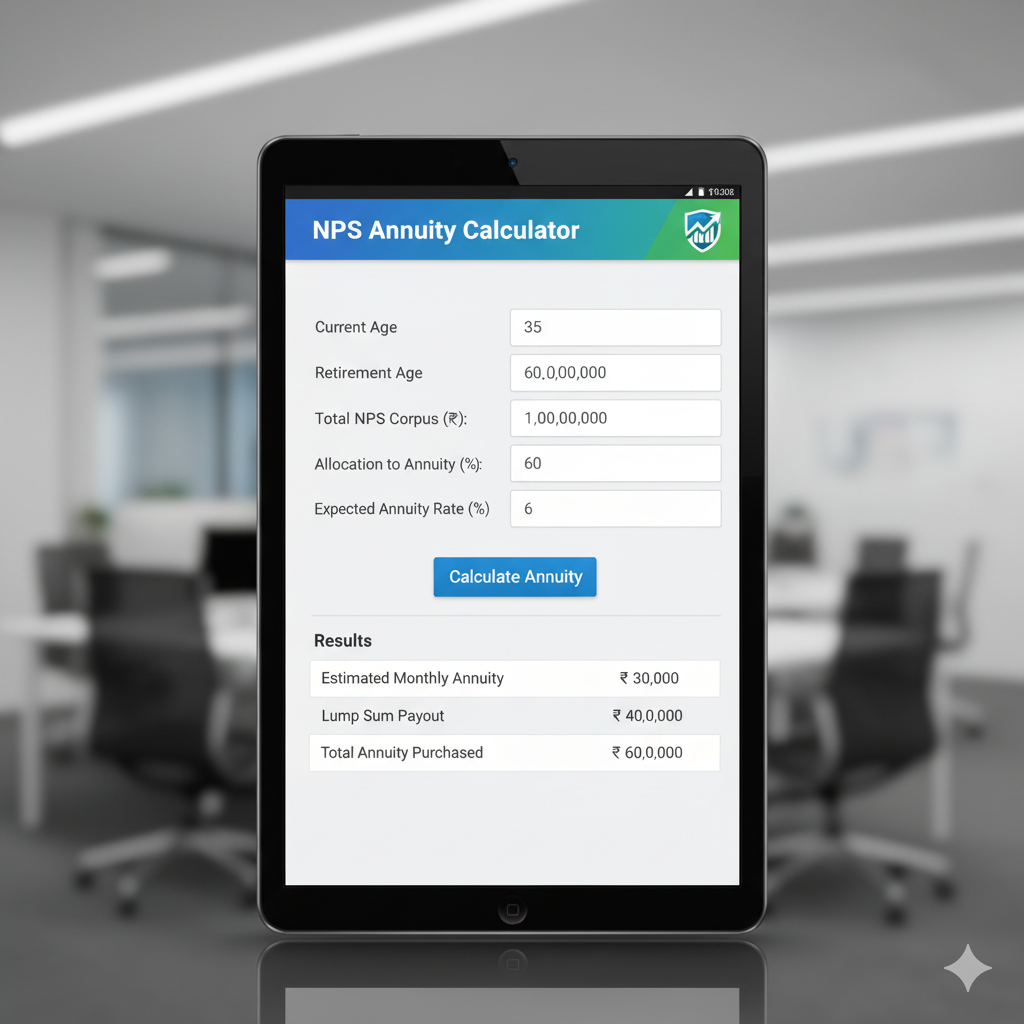

NPS Annuity Calculator

Estimate your monthly pension from the National Pension System (NPS)

Annuity Inputs

Estimated Annuity

Important Information

This is an estimation based on the inputs provided. Actual annuity amounts depend on prevailing interest rates offered by annuity service providers (ASPs) at the time of retirement, the specific annuity plan chosen, and tax regulations. As per NPS rules, at least 40% of the corpus must be used to purchase an annuity.

Planning for a comfy retirement is super important in today's world. People are living longer, and inflation keeps pushing up costs, so having a reliable income after you stop working is a must. In India, the National Pension System (NPS) is a standout choice—it's supported by the government, flexible, and connected to the market.A big part of NPS retirement planning is the annuity, which turns some of your saved-up money into a regular monthly pension. To make this clearer and easier to predict, the NPS Annuity Calculator is a handy tool for investors. In this guide, we'll cover what the NPS annuity is, how the calculator works, and why it's a game-changer for your financial future after retirement.

Understanding NPS Annuity

The National Pension System is a voluntary retirement plan where you contribute regularly, overseen by the Pension Fund Regulatory and Development Authority (PFRDA). It lets you invest in a mix of stocks, corporate bonds, and government securities to grow your retirement fund. When you retire, you can take out a chunk as a lump sum, and the rest buys an annuity that gives you a steady monthly income.

This annuity keeps you financially stable for life, covering everyday expenses and helping you keep your lifestyle. NPS has different annuity types, each with varying pension levels based on your risk level, strategy, and what you prefer.

What is the NPS Annuity Calculator

The NPS Annuity Calculator is an online tool that helps NPS users figure out the monthly pension they might get from their saved corpus. You enter details like your total corpus, the annuity type you pick, and the expected rate, and it gives you solid estimates of your income after retirement.

Some key things it does:

- Estimates your monthly pension.

- Shows the split between lump sum and annuity.

- Lets you compare different annuity options and how they affect your pension.

- Helps plan for long-term financial security.

Using this, you can make smarter choices about your annuity, contributions, and overall retirement setup.

How NPS Annuity Calculator Works

The calculator keeps it simple, focusing on your corpus and annuity rates:

- Input Corpus: Put in the total NPS savings you're using for the annuity.

- Select Annuity Scheme: Pick the kind of annuity, like a life annuity or one for you and your spouse.

- Expected Annuity Rate: Add the rate for that scheme.

- Monthly Pension Projection: It crunches the numbers to show your estimated monthly income.

You can play around with different scenarios, like changing your corpus or scheme, to find the best plan for your income needs.

Types of Annuity Options in NPS

NPS has several annuity choices to fit various needs and risks:

- Life Annuity: Gives you a fixed pension for your whole life.

- Joint Life Annuity: Keeps the pension going for you and your spouse's lifetimes.

- Life Annuity with Return of Purchase Price: Pays during your life, then returns the leftover to your nominee if you pass away.

- Increasing Annuity: Boosts your monthly pension each year to fight inflation.

- Life Annuity with Guaranteed Period: Locks in a fixed pension for a set number of years, even if you die early.

The calculator lets you compare these and pick what suits your retirement plans.

Example of Using NPS Annuity Calculator

Imagine you've got ₹50 lakh in your NPS at retirement:

- Selected Annuity Scheme: Life Annuity with 5% increasing pension.

- Expected Annuity Rate: 6%

The calculator might show:

- Initial Monthly Pension: ₹25,000

- Yearly Increment: 5%

- Pension for the first 10 years: ₹25,000–₹38,000

- And it keeps growing after that.

This gives you a real sense of your future income, making it easier to budget for retirement.

Benefits of Using NPS Annuity Calculator

This tool brings a lot to the table:

- Clarity on Pension Income: Know exactly what your monthly check might look like.

- Comparative Analysis: Check out different schemes to find the right one.

- Decision-Making Aid: Helps decide how much to put toward annuity vs. lump sum.

- Financial Planning: Fits into your bigger retirement picture for enough income.

- Time-Saving: Quick math without the hassle.

Factors Affecting NPS Annuity

Your projected pension depends on a few things:

- Corpus Amount: Bigger savings mean a higher pension.

- Selected Annuity Scheme: Each type has its own payout style and protections.

- Annuity Rate: The provider's rate directly affects your monthly amount.

- Age at Retirement: Older folks might get more since payouts are based on life expectancy.

- Inflation: Options that increase help keep your money's value up.

- Spouse Benefits: Including a spouse might lower the start but keeps income flowing.

How to Use NPS Annuity Calculator Effectively

To get the most out of it, think about your needs:

- Figure out your annuity-ready corpus.

- Estimate your monthly expenses after retirement.

- Try different schemes based on your risk and goals.

- Enter rates and details.

- Look at the pension projection and tweak the split if needed.

- Go for increasing options to handle inflation.

Trying various setups helps you craft a plan for steady income forever.

Advantages of Investing in NPS

NPS has some great perks beyond annuities:

- Government-Backed Scheme: Safe and clear under PFRDA.

- Market-Linked Growth: Stocks, bonds, and securities can grow your money faster.

- Flexible Contribution Options: Pay monthly or yearly as it suits you.

- Tax Benefits: Deductions under Section 80C, extra under 80CCD(1B), and employer under 80CCD(2).

- Portability: Easy to keep across jobs and moves.

The calculator ties in nicely, showing your income after.

NPS Annuity Calculator vs Manual Estimation

You could do back-of-the-envelope math, but the calculator gives:

- Precise pension estimates from corpus, scheme, and rate.

- Easy comparisons of schemes.

- Quick scenario tests without number-crunching.

- Fast results for better decisions.

It's a must for today's planning.

Limitations of NPS Annuity Calculator

It's helpful, but keep in mind:

- Just estimates, not locked-in amounts.

- Rates might change by retirement, shifting your pension.

- Inflation handling is limited unless you pick increasing options.

- Assumes average life spans; yours might differ.

Use it as a starting point and add other planning.

Maximizing Retirement Benefits Using NPS Annuity Calculator

To boost your security:

- Start NPS early for a bigger corpus.

- Decide annuity portion based on needs.

- Choose schemes that beat inflation and last a lifetime.

- Check projections often and adjust.

- Mix with other income sources for the best setup.

Future of NPS Annuity Calculators

As tech advances, these calculators will get smarter:

- AI for custom forecasts based on your details.

- Inflation tweaks for real buying power.

- Apps for on-the-go income tracking.

- Testing multiple schemes for the perfect fit.

This will make planning even better and easier.

Frequently Asked Questions on NPS Annuity Calculator

Conclusion

The NPS Annuity Calculator is a must for NPS folks. It clears up your post-retirement income, helps pick the best scheme, and guides corpus decisions.

By using it regularly, trying scenarios, and matching contributions to goals, you can aim for a stable retirement. With NPS's growth, support, and tax wins, this tool lets you plan with confidence for freedom and ease later on.