NPS Vatsalya Calculator

Estimate your future corpus for child’s education or marriage

Child’s Information

Investment Details

Projected Corpus

Planning for the future is something we all need to tackle, whether it’s saving for a relaxed retirement, funding a kid’s education, or building a solid safety net. In India, with so many investment choices out there, the National Pension System (NPS) stands out as a reliable option – it’s backed by the government, comes with tax perks, and offers plenty of flexibility.

One cool feature of this system is the NPS Vatsalya Plan, mainly rolled out through SBI (State Bank of India). It’s all about helping parents or guardians set aside money systematically for their child’s higher education and overall financial security. To make this planning easier, the NPS Vatsalya Calculator is a super useful online tool that gives you quick estimates on returns, total savings, and future benefits.

This guide breaks down what the NPS Vatsalya Calculator is, how it ticks, and why it’s become such a handy resource for folks investing in their kids’ tomorrow.

Understanding the NPS Vatsalya Scheme

The NPS Vatsalya Scheme is a kid-centred savings plan that’s part of the bigger National Pension System. Unlike the standard NPS that’s geared toward retirement, this one is tailored to cover things like growing education costs and other child-related needs.

Parents or guardians can set up an NPS Vatsalya account in their child’s name and keep adding to it until the kid hits a certain age. The money grows through investments in market stuff like stocks, government bonds, and corporate debt, based on what mix you pick.

The main goals here are to:

- Build up a hefty fund for the child’s education over time.

- Get growth from the market while sticking to a regular saving habit.

- Grab tax benefits for the person putting in the money.

- Set the child up for a secure financial start with smart planning.

And to make all this planning a breeze, the NPS Vatsalya Calculator is key.

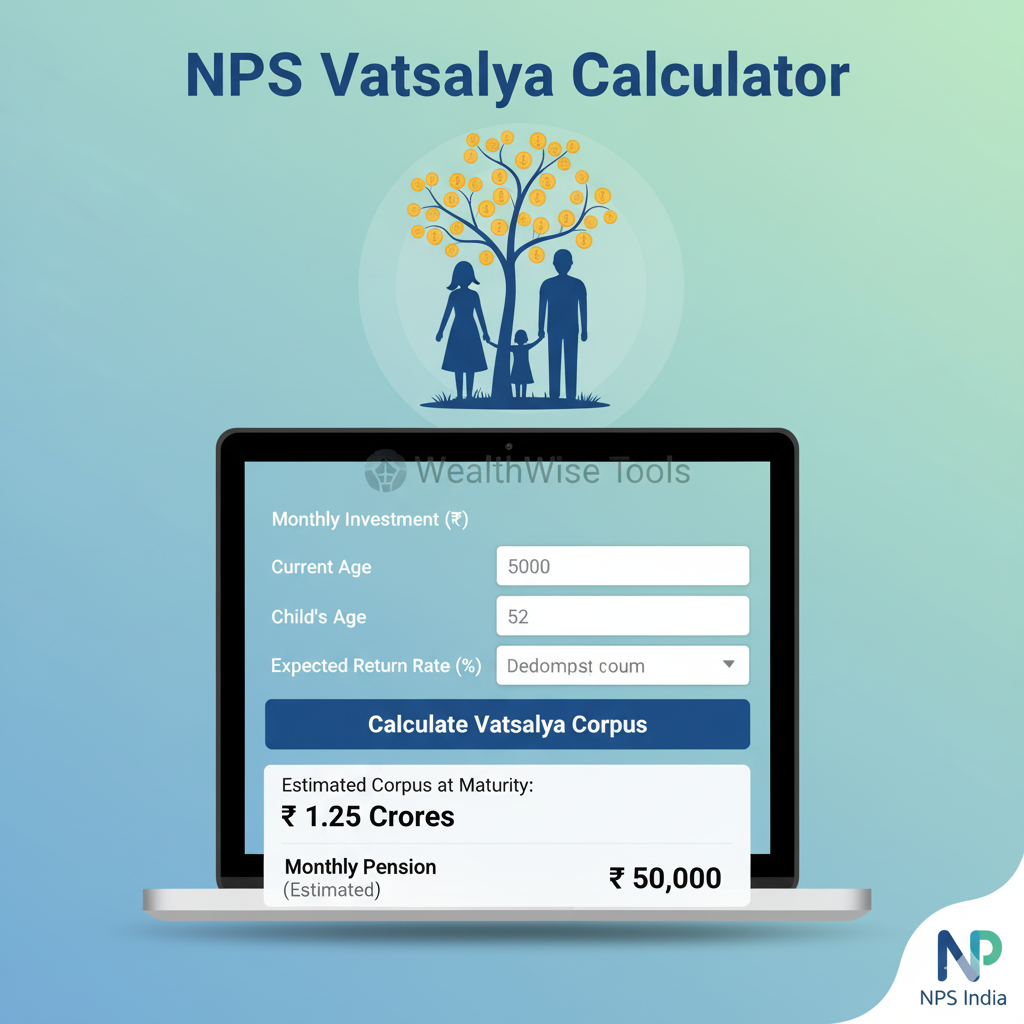

What is the NPS Vatsalya Calculator

The NPS Vatsalya Calculator is an online tool that lets guardians figure out the total savings at maturity and other perks from investing in the scheme. You just plug in details like how much you’re contributing, how long you’ll invest, the expected return rate, and when you’ll need the money. It then gives you a pretty spot-on idea of how your investment will grow.

Ditching those complicated manual math sessions, this tool delivers clear results in no time. It helps parents set achievable goals for their kid’s future, especially with education costs climbing every year.

How the NPS Vatsalya Calculator Works

The calculator is simple to use but packs a punch. It relies on compounding – where your money earns on itself – and regular contributions.

You start by entering stuff like:

- The child’s current age.

- The age when you’ll need the funds (say, 18 for college).

- How much you’re putting in monthly or yearly.

- The expected yearly return rate.

It then estimates the total fund by the time it’s needed.

Some versions even break it down into lump sum withdrawals, the annuity part, and potential pension if that’s in play.

You can tweak things like contributions or time frames to fit your budget and goals perfectly.

This kind of forecasting makes it a go-to for planning.

Example of NPS Vatsalya Calculator in Action

Imagine a parent kicking off contributions for their little one:

- Child’s age now: 5.

- Age when funds are needed: 18.

- Monthly contribution: ₹5,000.

- Expected return: 9% a year.

After 13 years of steady saving, it might show:

- Total corpus at 18: About ₹14–15 lakh.

- Lump sum withdrawal: ₹8–9 lakh.

- The rest: Kept invested or drawn out in a structured way.

This example really shows how consistent inputs and compounding team up to create a solid education pot.

Benefits of Using the NPS Vatsalya Calculator

There are tonnes of upsides for parents using this calculator:

- Clarity on Future Savings: Set real targets for your child’s education fund.

- Helps in Contribution Planning: Figure out the perfect monthly amount by playing with the numbers.

- Visualisation of Growth: See how your savings build up year by year.

- Financial Discipline: It motivates you to save regularly for those big goals.

- Comparison Tool: Test out different scenarios to pick the best approach.

Key Factors Affecting NPS Vatsalya Calculator Results

The estimates are pretty good, but they hinge on a few things:

- Contribution Amount: More in each month or year means a bigger pile at the end.

- Tenure of Investment: Starting young gives compounding more time to shine.

- Rate of Return: This depends on your investment choices and directly affects the outcome.

- Market Performance: Stocks can boost growth but come with ups and downs.

- Annuity Option: If part goes to an annuity, the rate at that time plays into future payouts.

Steps to Use the NPS Vatsalya Calculator

It’s straightforward for parents or guardians:

- Head to the official SBI NPS Vatsalya site or a reliable financial portal.

- Put in the child’s age and the target age for needing the money.

- Add your contribution amount and how often.

- Pick an expected return rate based on the market.

- Check the projections and tweak if you need to.

Its ease means anyone can plan; no finance degree is required.

Advantages of NPS Vatsalya Scheme

Beyond the calculator, the scheme has some great features:

- Government-Backed Security: Overseen by PFRDA for safety and clear rules.

- Dual Purpose: Funds education while teaching saving habits.

- Tax Deductions: Qualifies under Sections 80C and 80CCD.

- Market-Linked Growth: Mix of stocks and bonds for better potential returns.

- Flexibility: Adjust contributions based on your finances.

Limitations of the NPS Vatsalya Calculator

It’s helpful, but not perfect:

- Can’t nail down inflation, which hits education costs hard.

- Real returns might differ with market swings.

- Annuity rates could change by maturity, affecting payouts.

- It’s an estimate, not a promise.

So, factor in extra savings and rising costs when planning.

Why Every Parent Should Use the NPS Vatsalya Calculator

Education prices are skyrocketing in India and beyond. Without a solid plan, it can get overwhelming. This calculator lets parents:

- Gauge exactly what’s needed for school.

- Avoid falling short by planning early.

- Decide wisely on how much and how often to contribute.

- Grow a stable fund without messing up daily budgets.

Basically, it adds clarity, routine, and smarts to family finances.

Future of NPS Vatsalya and Digital Calculators

As digital money tools get bigger, calculators like this will level up with things like:

- Projections that factor in inflation.

- AI for custom tips.

- Side-by-side comparisons with other kid plans.

- App links for instant updates.

This will make planning even sharper and easier for families.

Frequently Asked Questions on NPS Vatsalya Calculator

Conclusion

The NPS Vatsalya Calculator isn’t just about numbers – it’s a helpful guide for parents securing their child’s path ahead. Showing education savings and perks, it brings motivation and focus to investing smartly.

With education getting pricier, old-school savings might not cut it. The NPS Vatsalya Scheme, with its calculator, gives a structured, government-supported, growth-focused fix. For parents aiming for their kids’ independence and top-notch education, this calculator is a key partner in financial planning.